Personal loan requirements you should know before applying

Personal loan requirements vary among individual lenders or lending institutions. Each lender has its criteria with terms and conditions. These policies are a determinant factor in whether or not you qualify for a loan or not. It helps them determine if you can pay it back as agreed on their contract.

Other than the mandatory documentation required for paperwork, here is what you need to know before applying for any loan.

- Credit score and credit history

Check your credit score and report any issues that may deter you from verification. Clear all pending loans; this can hinder your qualifications. A good credit score is a sign to be trusted that you will pay back on time. A tremendous amount means your interest rate will be lower than one with a low credit score.

- Income

You need to prove all your income sources accustomed to accessing a loan. If you are an employee, you'll need a salary letter from your employer. W-2 forms and at least pay slips of the last three months' salary. Self-employed applicants must provide tax returns of a minimum of two years and a bank statement indicating their income.

All other sources of your income are essential together with your primary source of income. This can include child support, businesses, freelancing jobs, child support, or spouse's income.

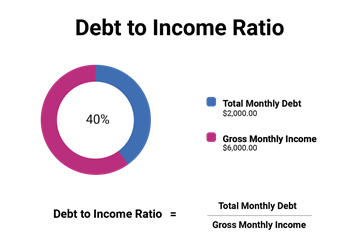

- Debt to income ratio

The monthly deductions from your income are calculated to cover your loan. This determines the prospective borrowers' ability to make payments on new and current debts: the higher your DTI, the higher your chances of receiving an immense amount.

- Collateral

Personal loans can also be secured with real estate, cash, investment accounts, coins, and precious metals. Secure loans also require additional information on ownership and social security number. A collateral loan means you are likely to lose your assets in case of default. However, if your loan is partially paid, then the lender can only take a share of the unpaid amount and give back the rest.

- Original fees

This is not guaranteed, but some lenders ask for original loan fees to cover the cost of application and running credit checks. Some collect these fees at the deal's closing, while others deduct them from the loan. It may range from 1% to 8% of the total amount of money.

Documentations

When it comes to a personal loan lender, every lender will require personal information, including your residence and confidential information. Both online and physical lenders work similarly. You must attain a legal age of 18 to apply for any loan. Documentations including your identification card, passport, driving license, and birth certificate must be proved to avoid theft.

The lender also must prove that you are in a state of paying back. Your address bills, rent documents, rentals, voters' cards, and insurance covers can determine whether you are responsible enough to pay back.

Bottom-line

Before applying for any loan, visit your provider to guide you on the best approach and the proper documentation. You can now get yourself a cosigner and choose a personal secured loan.